Who Pays a Real Estate Agent When Buying a Home?

When buying a home, the seller typically pays both the listing agent and the buyer’s agent.

Buying a House Out of State? 4 Things to Consider First

If you’re going to be buying a house out of state, make sure that you’re working with a reputable top agent in your new community.

Condo vs. Townhome: What's the Big Difference?

Curious about condo vs townhome? A condo is a unit in a larger property, and a townhome refers to a single-family home sharing walls with another home.

Contingent vs. Under Contract: What's the Difference?

What’s the difference between contingent vs under contract? Contingent means buyers and sellers can back out of the deal if certain terms are not met.

How Much Cash Should You Put Towards a Home Down Payment?

For a home down payment, it’s generally best to put down at least 20%. But, this standard is not a requirement and it’s possible to put down less than 20%.

What is a Good Credit Score for a First-Time Homebuyer?

What is a good credit score to buy a home? Ranging between 650 and 850 is optimum, but it is possible to secure a good deal with a score below 620.

5 Things that Impact the Price of a Home

A home’s location, features, age, and condition are amongst the factors that impact the price of a home when selling.

What’s the Debt to Income Ratio to Get a Mortgage?

While 43% is typically the maximum debt to income ratio to get a mortgage, lenders prefer a 36% debt to income ratio or lower to qualify for loan benefits.

Can You Buy a Home Without a Down Payment?

No down payment loans and down payment assistance programs are options available for those who wish to buy a home without a down payment.

3 Steps to Becoming a Real Estate Agent

Becoming a real estate agent includes a pre-licensing course, passing a licensing exam, and applying for your license. Here’s a look at the entire process.

What's the Difference Between a Buyer's and Seller's Market?

A buyers or sellers market means that a local real estate market is experiencing preferable conditions for one side of the transaction.

What's the Difference Between Adjustable and Fixed-Rate Mortgages?

To decide between an adjustable vs. fixed rate mortgage, speak to your lender and observe the current market conditions to find the loan best for you.

Agent or Lender: Who Should You Speak to First When Buying a Home?

Do I need to speak with a lender first or find my agent? To achieve a streamlined purchase, the best solution is to find both your agent and lender early.

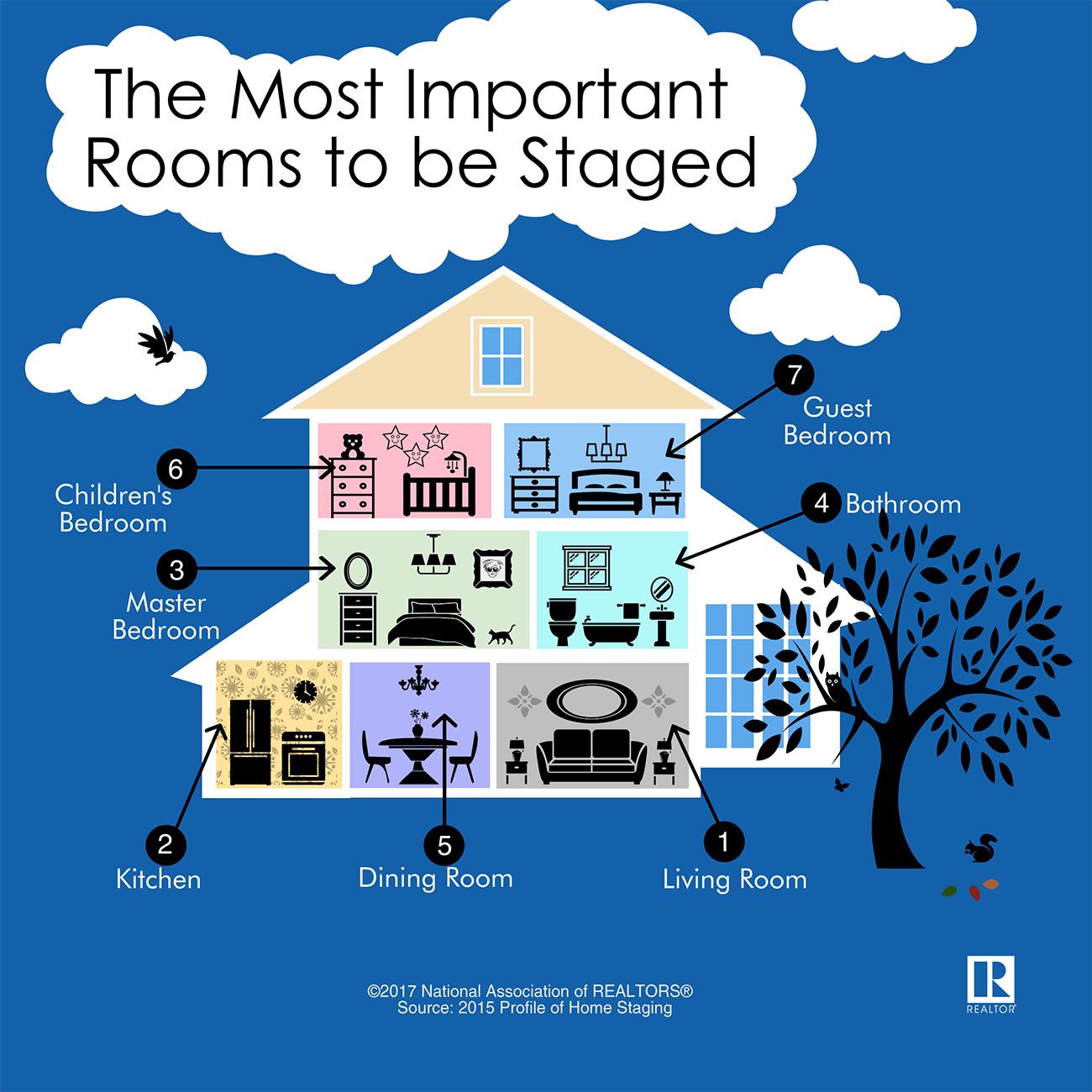

4 Secrets Top Selling Agents Will Tell You About Staging Your Home

Top selling agents know that staging your home before listing can potentially increase the value of your home and help it sell in less time.

What Credit Score Do You Need to Get a Mortgage?

What credit score do you need to get a mortgage? There are flexible loan options available for almost all credit scores.